As soon as the newly established business is registered with the Securities and Exchange Commission (SEC); it must register books of account for record-keeping of transactions which will be used as the basis to compute its internal revenue taxes. But to ensure effective financial reporting, the Bureau of Internal Revenue (BIR) introduced the use of Computerized Accounting System (CAS). A more efficient encoding of data through standardized digital programs and process in accounting and finance. As these particular systems deal directly with information relating to taxes owed to the government, there are steps that must be followed if a company is to adopt and use a CAS:

- File the PROPER TAX FORMS — specifically, file a BIR Form 1900 (Application for Authority to Adopt Computerized Accounting System or Components Thereof/Loose-leaf Books of Accounts, 2002 Enhanced Version) and/or BIR Form 1907 (Application for Permit to Use Cash Register Machine/Point of Sale Machine, 2002 Enhanced Version).

- Prepare the DOCUMENTARY REQUIREMENTS — when completing an Initial Application to Adopt CAS and/or Components Thereof, you must provide the following:

a. Your COMPANY PROFILE that is comprised of the of:

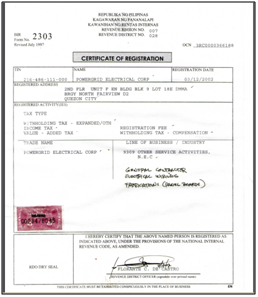

i. A photocopy of your BIR Certificate of Registration (sample provided).

ii. A photocopy of Previously Issued Permit, if applicable.

iii. A photocopy of your Current Registration Fee Payment.

iv. A location map of your place of business (sample provided).

v. An inventory of previously approved unused Invoices and Receipts, if applicable.

vi. A list of branches that will use be using the CAS you’re applying for, if any (provide location maps of the other branch offices if possible).

b. Provide the TECHNICAL REQUIREMENTS needed. They are comprised of the following:

i. The Application Name and Software Used (For System Development & Database)

1. Details on the Hardware (No. of Server/Workstations)

2. Server/Workstation specifications (Processor, Machine Brand/Model, Software and Version, Database Used, Operating System Used, and Software Developer/Provider)

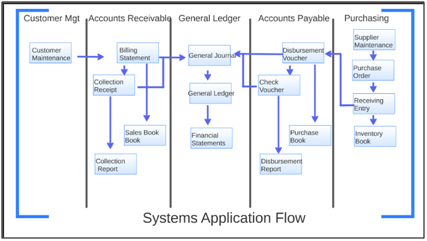

3. The Functions and Features of the Application (sample provided)

iii. The System Flow/s

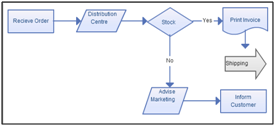

iv. The Process Flow

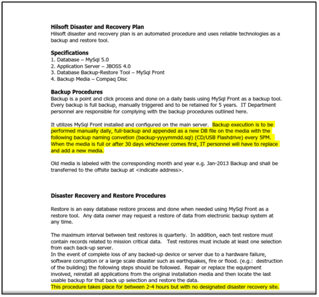

v. Proposed Back-up Procedure, Disaster, and Recovery Plan (sample provided)

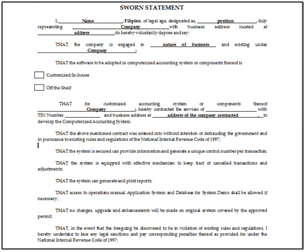

vi. Sworn Statement and Proof of System Ownership (sample provided)

vii. List of Reports and Correspondences that can be generated from the system with description (samples provided):

- Purchase Reports — provides a summary of information on purchase orders or purchase quotes. This report is useful in evaluating purchasing activities and reviewing purchase orders/quotes created within a specific period of time. Sample types:

a. Purchase Requisition

b. Purchase Order Reports

c. Receiving Reports

2. Sales Reports — a record of calls made and products sold during a particular time-frame kept by the salesperson or management. A typical sales report might incorporate data on (1) sales volume observed per item or group of items, (2) how many new and current accounts were contacted and when, and (3) any costs that we involved in promoting and selling products. Sample types:

a. Sales Order Reports

b. Sales Invoice Reports

3. Collection Reports (Accounts Receivable) — a report that lists unpaid customer invoices and unused credit memos by date ranges. The aging report is the primary tool used by collections personnel to determine which invoices are overdue for payment.

4. Voucher Reports (Accounts Payable) — a report that categorizes payables to suppliers based on payment terms.

5. Inventory Reports — a summary of items belonging to a business, industry, organization, or home. It provides a comprehensive account of the stock or supply of various items. Sample types:

a. Stock Card

b. Stock on Hand

6. General Ledger Reports — shows all transactions from all accounts for a chosen date range. Sample types:

a. Journal Voucher

b. General Journal

c. Sales Journal

d. Purchase Journal

e. Cash Receipt Book

f. Cash Disbursement Book

c. Provide a facsimile of System Generated Loose-leaf Books of Accounts and List thereof/Receipts/Invoices

d. Provided additional requirements in case of affiliated companies/sister companies, franchisees, and branches:

i. A photocopy of previously issued permit for mother/sister company or another branch using the same system, if applicable.

ii. Application from the Computerized System Evaluation Team (CSET), which previously evaluated the approved system (sample provided)

3. If you wish to update the CAS system that was already approved and installed in your company, you must file an Application for System Enhancement/Modification. They require the ff.:

a. A photocopy of the previously issued Permit to Adopt CAS or Components Thereof.

b. A letter to the BIR detailing the enhancement/modification to be made on the previously approved CAS or Components Thereof.

7 Comments

just click the up coming article · May 8, 2018 at 5:26 pm

We are a group of volunteers and opening a new scheme in our community. Your website offered us with valuable info to work on. You’ve done a formidable job and our entire community will be thankful to you.

hilsoftadmin · May 17, 2018 at 3:10 am

Hi! We’re glad that we’re able to share you information that can be helpful to your company. If you’re interested in getting updates of the latest tech news, you can also check our Facebook Page Hilsoft,Inc. Thank you 🙂

Agustin Dongo · May 24, 2018 at 11:01 am

You sure know what you’re talking about. Everyone is going to soon be visiting your site.

Damon · June 4, 2018 at 3:15 pm

Pretty! This has been an incredibly wonderful post.

Many thanks for providing these details.

Madeleine · June 15, 2018 at 1:27 pm

I enjoy the article

hilsoftadmin · June 21, 2018 at 11:06 am

Hi! We’re glad that you find our blog post insightful. If you’re interested in getting updates of the latest tech news or if there’s something innovative that you wanted to share with us, or any topic that you want us to feature, you may check our Facebook Page Hilsoft,Inc as well.

hilsoftadmin · June 21, 2018 at 11:08 am

Hi! We’re glad that you find our blog post insightful. If you’re interested in getting updates of the latest tech news or if there’s something innovative that you wanted to share with us, or any topic that you want us to feature, you may check our Facebook Page Hilsoft,Inc as well.